Brand new Company away from Casing and you will Urban Creativity (HUD) provides the Area 184 Financing Program make it possible for eligible Local People in america to buy a property having the lowest down payment as well as glamorous home loan pricing than the conventional mortgage programs. The fresh new HUD Section 184 Loan System is actually established in 1992 to help you boost owning a home and you may boost entry to home loan resource into the Native American groups. HUD guarantees 100% of one’s mortgage count getting Point 184 finance, and therefore protects the financial institution of losing profits when the borrowers usually do not repay its financial. Point 184 Fund are provided due to acting Native Western people by way of a medication 3rd-people bank, such a financial, home loan financial, mortgage broker or borrowing connection. Acting tribes invest in certain system assistance approaching mortgage conditions, property liberties and you will home supply. Once the system is only given by way of playing Native American tribes, Part 184 Finance are just obtainable in chose says and you can areas.

Some great benefits of a paragraph 184 Mortgage is you can purchase a house which have a down-payment as little as dos.25% (to possess home loan number over $fifty,000) otherwise step 1.25% (getting mortgage numbers lower than $fifty,000). Section 184 Finance also offer attractive mortgage rates plus flexible borrower certification requirements, that assist way more borrowers be eligible for mortgages purchasing residential property. Point 184 Loan mortgage pricing are straight down since the government, thanks americash loans Penrose to HUD, means the loan .

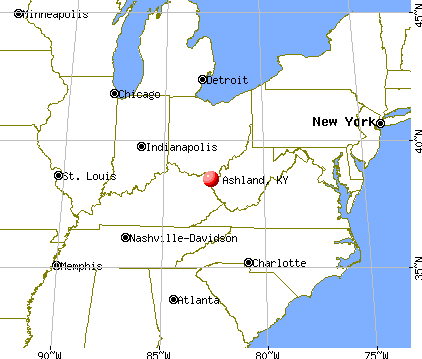

We details this new geographical method of getting the brand new Area 184 Loan System lower than

- Power to buy a house that have a reduced down payment (2.25% to own loans more than $50,000) and you can restricted debtor monetary contribution

- Glamorous home loan rates

- Flexible debtor certification requirements (no credit history necessary, case-by-situation approval)

- Relates to each other home buy money and you may refinances

- Are used for new home design and you may possessions rehab

- No debtor income limitations

I details the fresh geographic method of getting this new Point 184 Financing Program below

- Geographical assets qualifications limitations

- Financing limitations

- Apparently lower debtor obligations-to-earnings proportion restrict

- Need upfront and continuing home loan insurance costs (be certain that costs)

No matter if HUD determines system guidelines and you can borrower eligibility, individuals sign up for Section 184 Finance owing to recognized loan providers such as banks, home loan banking companies, home loans and you will borrowing unions. Such approved lenders guarantee that applicants satisfy Part 184 mortgage conditions and you can be eligible for the applying according to HUD guidelines. Using people can provide a list of recognized lenders or you can view a listing of Point 184 Lenders towards HUD webpages .

Utilize the FREEandCLEAR Lender List to track down loan providers in your state offering Area 184 Loans and you can a wide range of most other zero or low-down payment programs

Borrowers is also mix an enthusiastic Section 184 mortgage which have a deposit grant , closure rates recommendations program, licensed subordinated 2nd home loan, personal gift or company system to greatly help pay for a down commission, closing costs otherwise property home improvements, allowing the latest debtor to invest in a home with reduced personal economic share. Down payment and you can closure rates direction offers and additionally certified subordinated next mortgages are generally offered using county otherwise regional houses agencies or Native American houses authorities otherwise tribes.

To be qualified to receive new Point 184 Program, you should satisfy specific debtor certification criteria and stay currently signed up as the a member of a good federally recognized Indigenous American tribe. We need to focus on that in case a couple sign up for a section 184 loan since the co-borrowers — particularly spouses — only one of the candidates is required to be a good tribal member.

Individuals are required to offer confirmation of its subscription from inside the a beneficial tribe when they get the application form. You need to speak to your group having questions about the new registration and you may confirmation processes since none loan providers nor HUD do you to definitely mode.

Please be aware that tribes you to participate in the program influence brand new locations that Area 184 Loans may be used and therefore that system is obtainable in specific states or simply in specific counties within specific says. Take note that property being funded doesn’t need to be located into tribal trust otherwise federally-designated Native American belongings to get entitled to the application form because the a lot of time since it is based in an eligible state or county.